tax avoidance vs tax evasion uk

ACIT Bombay High Court DCIT. This comes down to a number of factors including criminality evasion and tax avoidance.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

On Wednesday 4 May Foreign Secretary Liz Truss announced a ban on the export of services by UK persons or entities to businesses in Russia.

. It adds insult to injury that a billionaire real estate mogul made EXACTLY this argument when selling his tax policy and business conduct Im just being a good businessman and Ill fix the rigged system by getting rid of loopholes then turned around and got rid of special deductions for normal folks and created a massive special interest handout for real estate moguls. UOI Bombay High Court Teleperformance Global Services Private Limited vs. Tax avoidance and tax evasion.

022 2203 6119 E Mail. In 1795 this tax was imposed and it led to a decline in use of wigs. 445 Library Maharashi Karve Road Mumbai 400 020.

022 2205 5138 Fax. On the other hand as you said if youre rich the progressive tax rates make it worth it to avoid taxes by funneling money around and we engineers developers etc get fucked because we earn above average and get hit with taxes hard but still not enough to make it worthwile to do the whole tax-avoidance legal thing. Co Income Tax Appellate Tribunal Old CGO Building 4th Floor Room No.

Concepts related to tax. Deadweight weflare loss of tax. The tax burden measures the true economic weight of the tax measured by the difference between real incomes or utilities before and after imposing.

Tax cuts essay on pros and cons of tax cuts. In economics tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfareEconomists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. They fell out of fashion.

A similar system is available in the United Kingdom and is known as the Individual Savings Account. Tata Communications Ltd vs. Prohibited services include accountancy management consult.

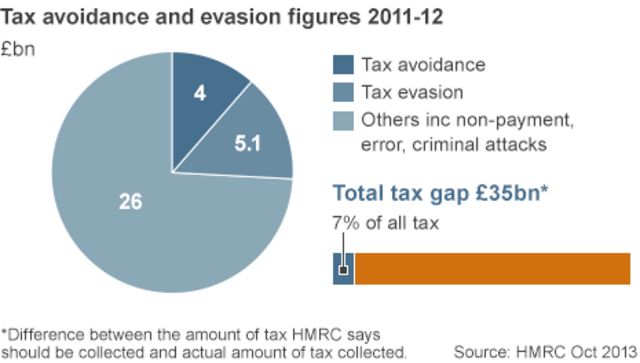

Tax rates by country. Tax on the aromatic powders put on wigs. There are also less nefarious reasons for the tax gap as taxpayers may mistakenly report the wrong amount on which they will be paying tax in the coming year.

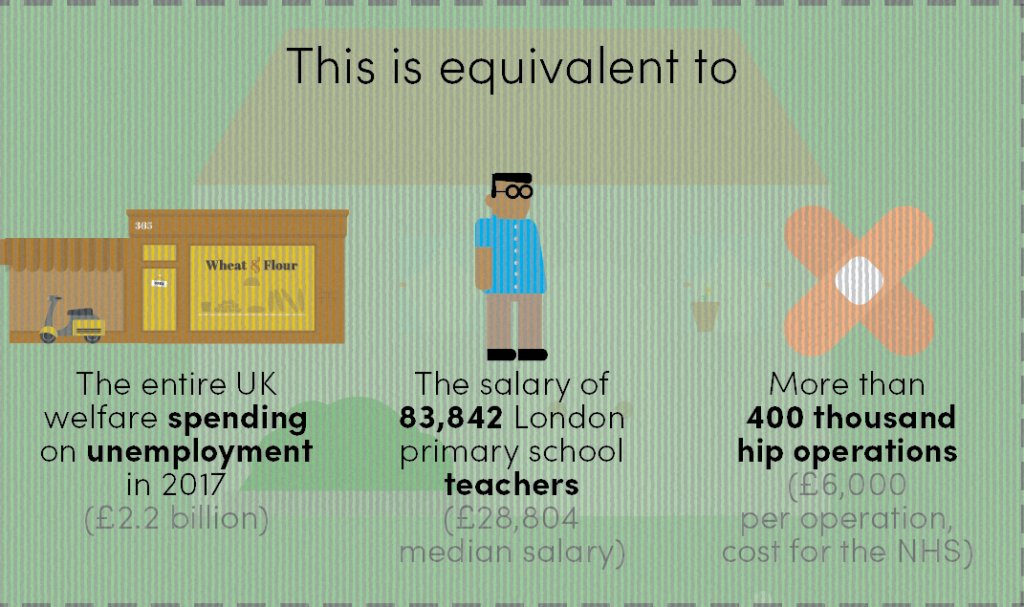

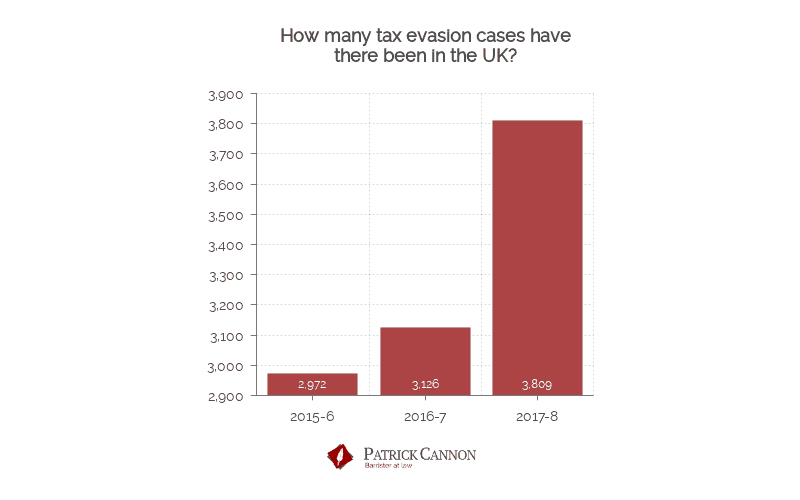

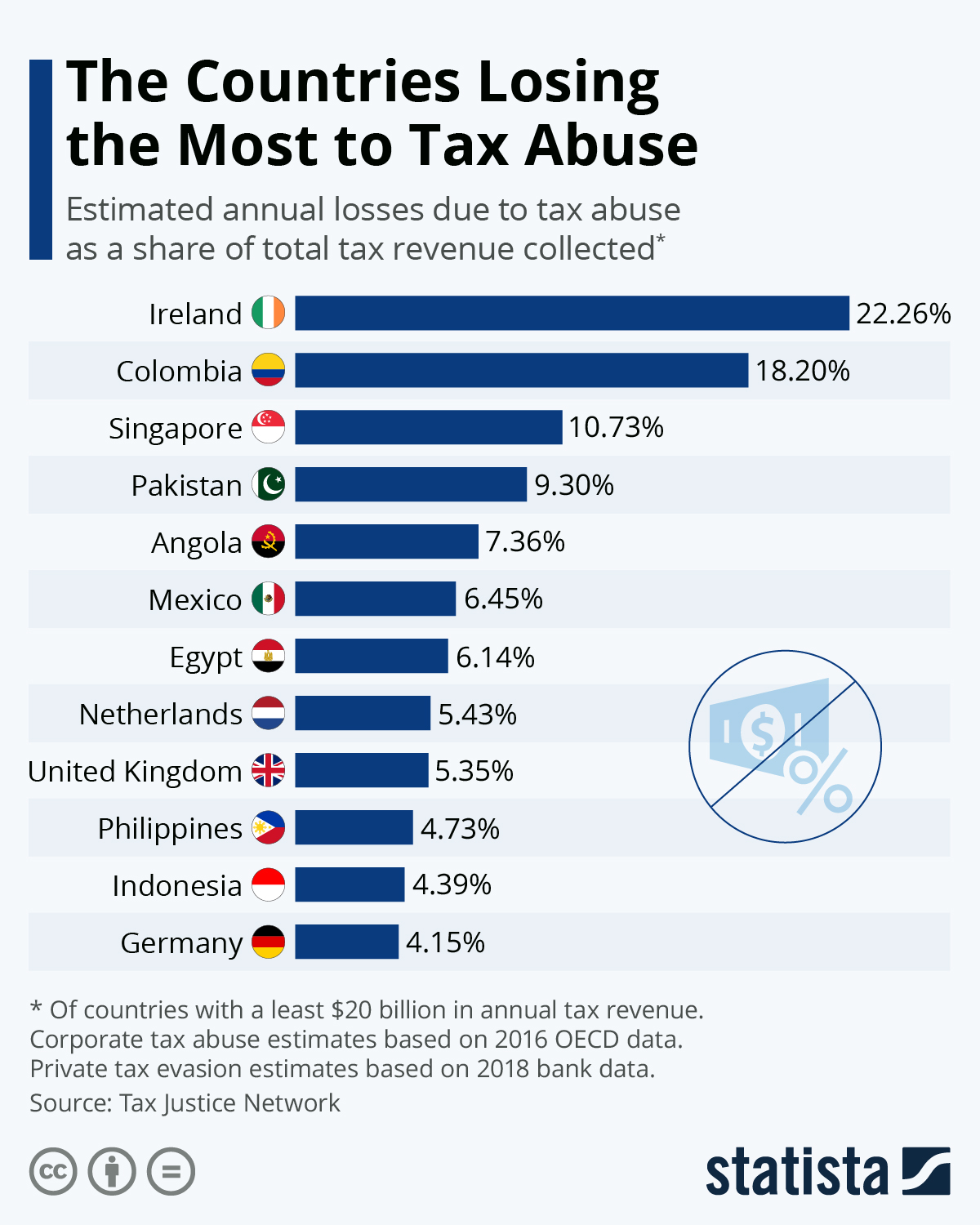

In 20172018 the tax gap was 35 billion pounds which makes up 56 of all tax liabilities. These tax shelters are usually created by the government to promote a certain desirable behavior usually a long-term investment to help the economy.

How Much Does Tax Avoidance Cost

James Melville Pa Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Revk S Ramblings Tax Avoidance

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Avoidance Vs Tax Evasion What S The Difference

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Evasion Vs Tax Avoidance Tax Consultant In Uk

When Is It Ok To Have A Swiss Bank Account Bbc News

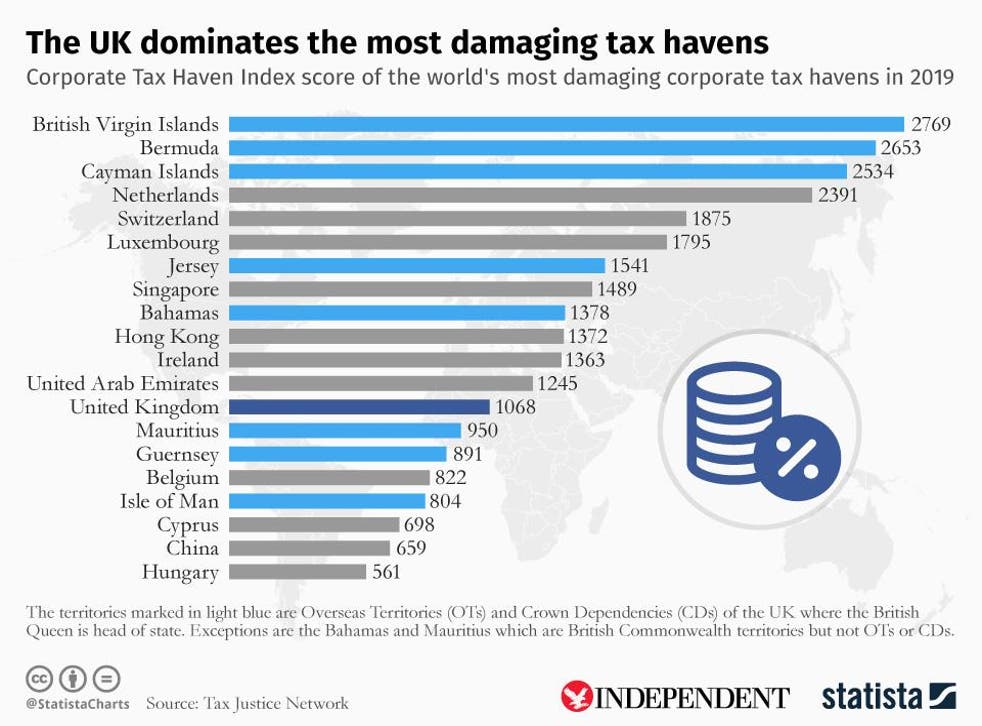

Uk By Far The Biggest Enabler Of Global Corporate Tax Dodging Groundbreaking Research Finds The Independent The Independent

Uk Second Best At Tax Avoidance

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar