new mexico gross receipts tax form

Identification Information Citation Citation Information Originator New Mexico Taxation and Revenue Department - Information Technology Division Publication Date 2022-06-08 Publication Time 141401 Title New Mexico Gross Receipts Tax Districts July-December 2022 Geospatial Data Presentation Form vector digital data Publication Information. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more.

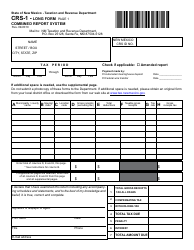

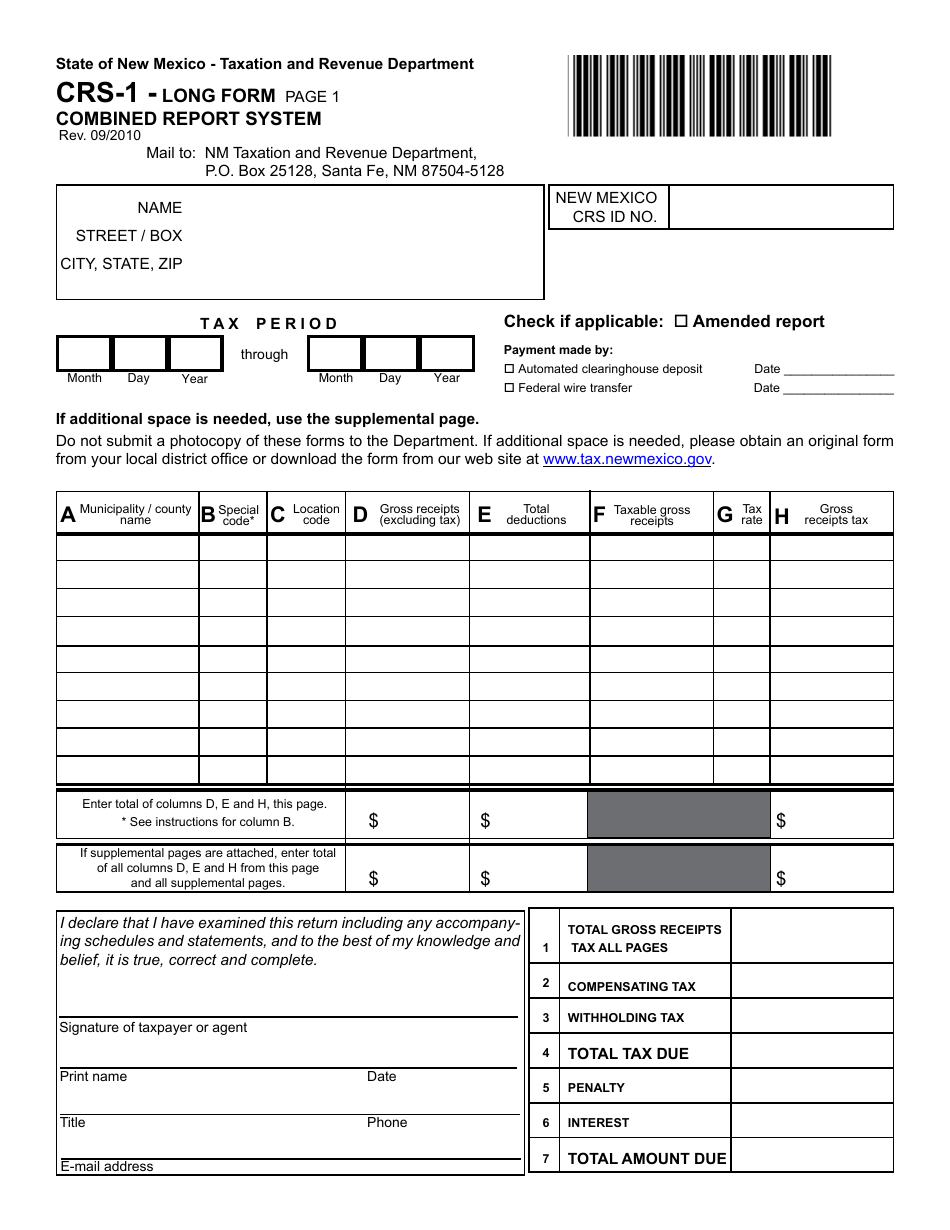

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Welcome to the Taxation and Revenue Departments Forms Publications page.

. Certain taxpayers are required to filethe Form CRS-1 electronically. This document provides instructions for the New Mexico combined reporting system Form CRS-1 which includes gross receipts withholding and compensating tax. By June 30 2021 in Avalara AvaTax create a new filing request for the NM Compensating Tax return form USNMTRD41412 effective 612021.

New mexico gross receipts tax on real estate commissions. For example centrally billed accounts are not subject to gross receipts taxes on tangible property. Used to apply for a refund of most taxes and fees paid to the state of New Mexico.

If your company reports Consumer use tax. Downloading Forms and Instructions To download tax forms follow these steps. Business with an average total tax liability of over 200 per month for any combination of taxes shown on the Form TRD-41413 Gross Receipts Tax Return must report monthly.

Open them via integrated services for modifying or eSigning. TaxFormFinder provides printable PDF copies of 81 current New Mexico income tax forms. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

Click a form to download it. The folders on this page contain everything from returns and instructions to payment vouchers for both income tax programs and business tax programs. New mexico cities counties and public schools.

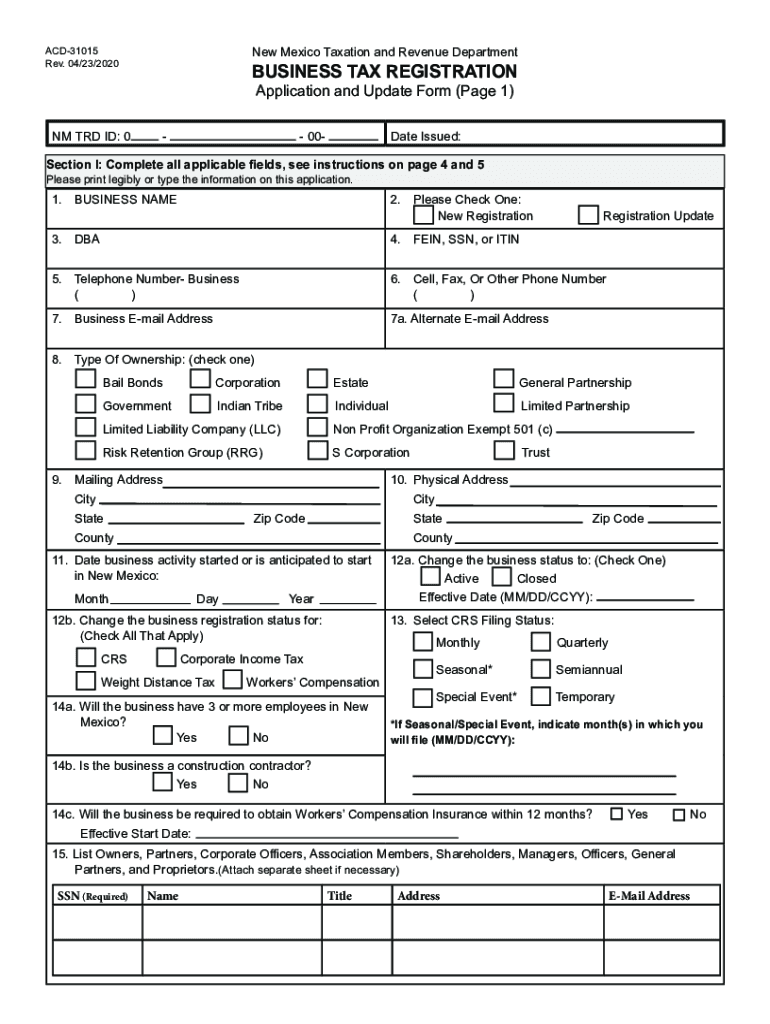

09132016 State of New Mexico - Taxation and Revenue Department GROSS RECEIPTS TAX CREDIT FOR CERTAIN UNPAID DOCTOR SERVICES To claim the credit attach a completed Form RPD-41323 Gross Receipts Tax Credit for Certain Unpaid Doctor Services to the CRS-1 return on or before the due date of the return. A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. Report the regular gross receipts tax the leased vehicle gross receipts tax and the leased vehicle surcharge on the CRS-1 Form.

Your browser may ask you to allow pop-ups from this website. Electronic transactions are safe and secure. Get wanted forms for New Mexico Operating marketplaces for sellers of goods and or services.

No forms are required. Businesses with a lower annual average than 200 monthly in combined taxes may elect to report monthly quarterly or semiannually. The location code for leased vehicle gross receipts tax is 44-444 and the location code for the leased vehicle surcharge is 44-455.

Check the Print Quality. Directions for downloading forms. Avalara will expire the NM SRS1 Long Form Combined and will update to the Gross Receipts Tax return form USNMTRD41413 with an effective date of 612021.

While an RST is a transaction tax imposed on the sale of tangible personal property and certain enumerated services the GRT is imposed on the privilege of doing business in New Mexico. You can locate tax rates Tax Authorizations Decisions and Orders and Statutes Regulations. Take full advantage of digital document management.

After registering the business will be issued a Combined Reporting System CRS Number sometimes known as a New Mexico Tax Identification Number. New mexico gross receipts tax. A GRT is a state tax collected by state and local governments across the US.

Allow the pop-ups and double-click the form again. Technology jobs tax credit may be applied against gross receipts compensating or withholding tax. Laboratory partnership with small business tax credit may be claimed only by national laboratories operating in New Mexico and is applied against gross receipts taxes due up to 1800000 excluding local option gross receipts taxes.

222012 New Mexico Taxation and Revenue Department Advanced Energy Gross Receipts Tax Deduction Report A AS REPORTED ON THE ATTACHED TAX RETURN ON WHICH THE DEDUCTION WAS TAKEN Name New Mexico Business Tax Identification Number NMBTIN. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. They offer faster service than transactions via mail or in person.

Not required is filing an amended return due to overstating taxes due. Tax Return Fake Tax Return Income Tax Return Irs Tax Forms Vendors have the ability to pass the cost of the gross receipts tax to card holders. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

New mexico gross receipts tax form Sunday February 13 2022 Through Month Day Year Month Day. However the Federal Government is only exempt from specific types of transactions in New Mexico. Expand the folders below to find what you are looking for.

2At the top of the webpage click FORMS PUBLICA- TIONS. Advanced Energy Gross Receipts Tax Deduction Report Form RPD-41349 RPD-41349 Rev. Click on the Gross Receipts Tax folder.

We last updated the APPLICATION FOR REFUND in March 2022 so this is the latest version of. You can also search for a file. A 2-per-day leased vehicle surcharge is also imposed on certain vehicle leases.

New Mexicos GRT is a unique state tax that resembles the retail sales tax RST imposed by most other states but it differs from the RST in several ways. Receipts of the federal government state of new mexico or any indian nation tribe or pueblo from activities or transactions occurring on its sovereign territory or any agency or political subdivision of the new mexico taxation and revenue department foregoing. 3Locate the folders toward the bottom of the page click the Business Taxes folder.

Hotels and lodging however are considered intangible property and are subject to gross receipts tax. Each Form CRS-1 is due on or before the 25th of the month following the end of the tax period being reported. New mexico gross receipts tax 2021.

Information needed to register includes the. GROSS RECEIPTS TAX RATE SCHEDULE Effective July 1 2018 through December 31 2018 Municipality or County Location Code Rate Municipality or County Location Code Rate Albuquerque 02-100 78750 Fort Sumner 27-104 80000 Edgewood Bernalillo 02-334 78750 Remainder of County 27-027 66875 AISD PropertyNineteen Pueblos of NM 1 a c. 54 rows New Mexico has a state income tax that ranges between 17 and 49 which is administered by the New Mexico Taxation and Revenue Department.

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the. Compensating tax is an excise tax imposed on persons using property or services in New Mexico also called use tax or buyer pays.

Nm Lodgers Tax Report 2020 2022 Fill Out Tax Template Online Us Legal Forms

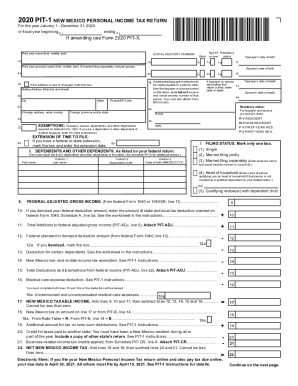

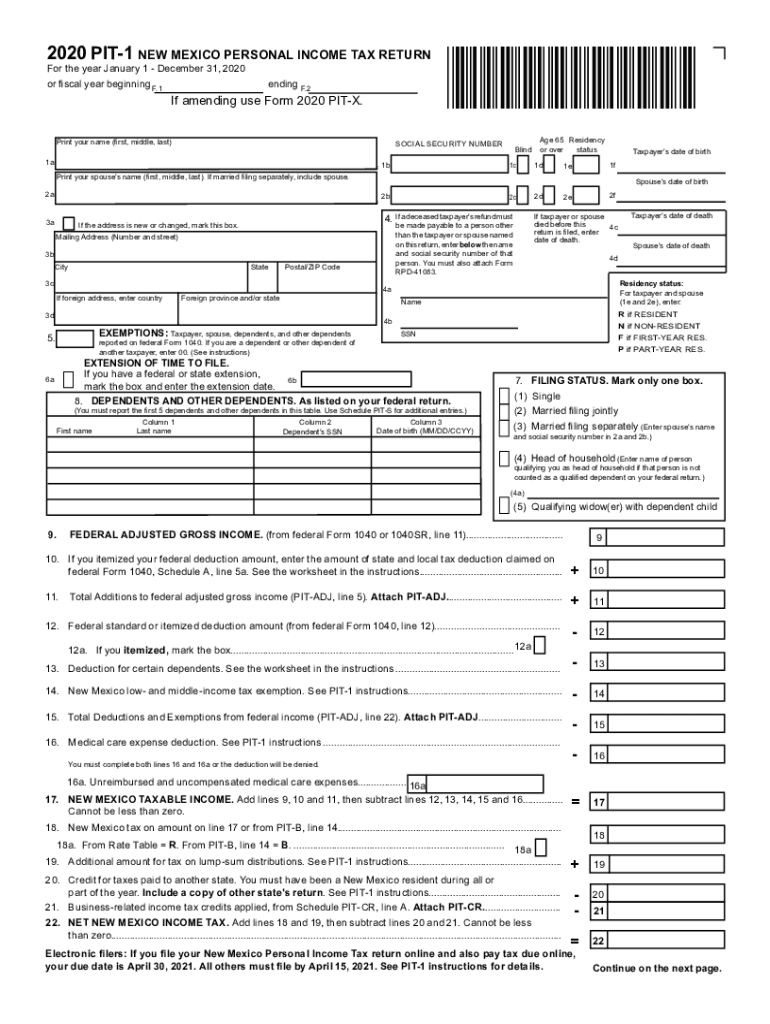

2020 2022 Form Nm Trd Pit 1 Fill Online Printable Fillable Blank Pdffiller

How To Register For A Sales Tax Permit In New Mexico Taxvalet

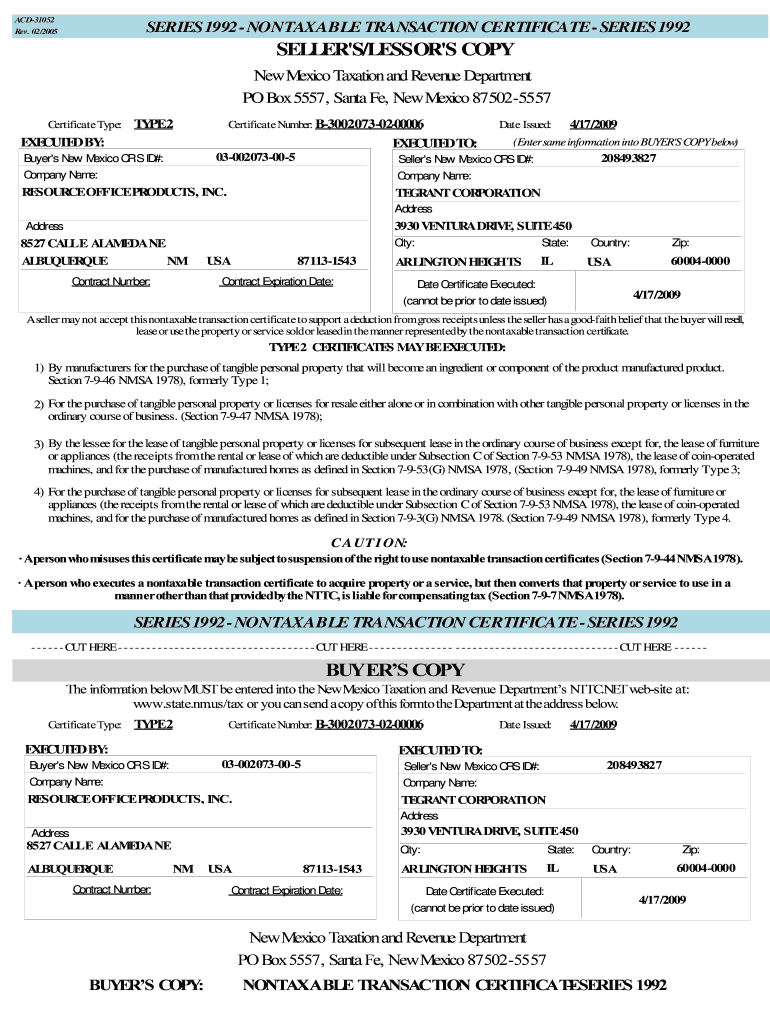

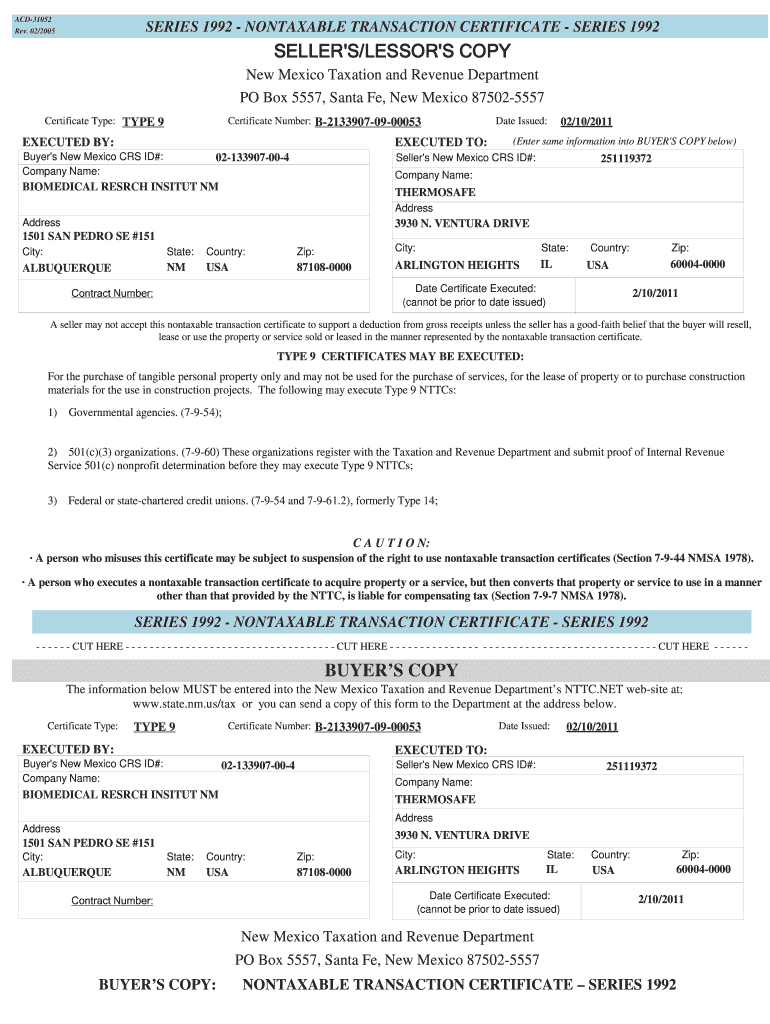

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

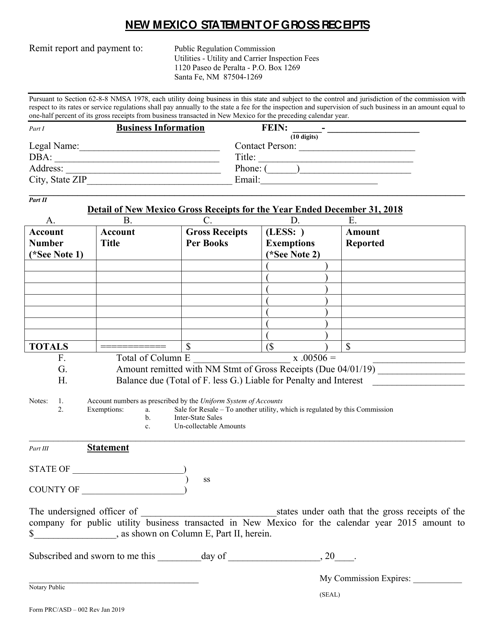

Form Prc Asd 002 Download Fillable Pdf Or Fill Online New Mexico Statement Of Gross Receipts New Mexico Templateroller

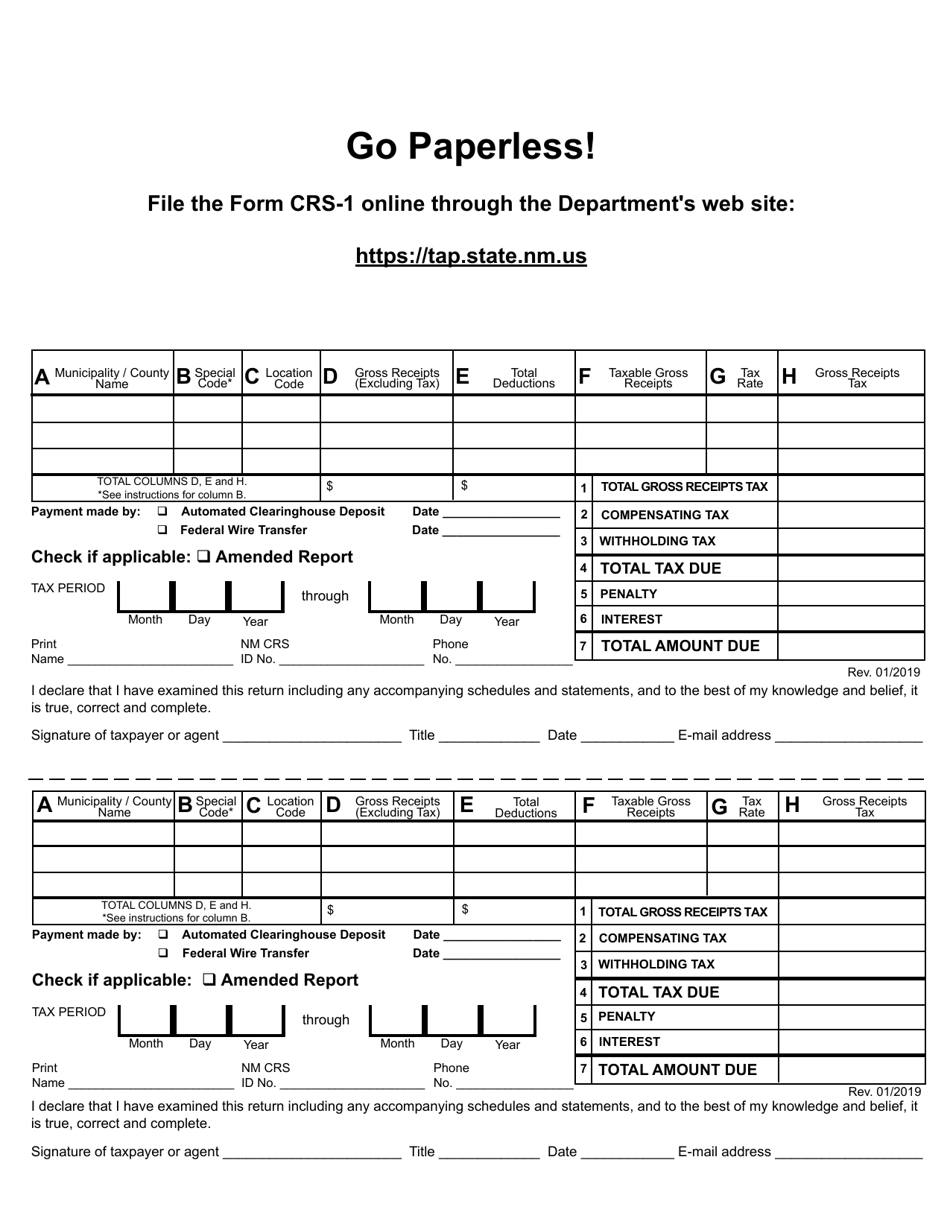

Crs 1 Short Form Crs 1 Combined Report Short Form For 3 Or Fewer Business Locations Codes Or Lines Of Detail

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Nttc Form Fill And Sign Printable Template Online Us Legal Forms

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Short Form For 3 Or Fewer Business New Mexico Templateroller

Form Rpd 41071 Fillable Application For Refund

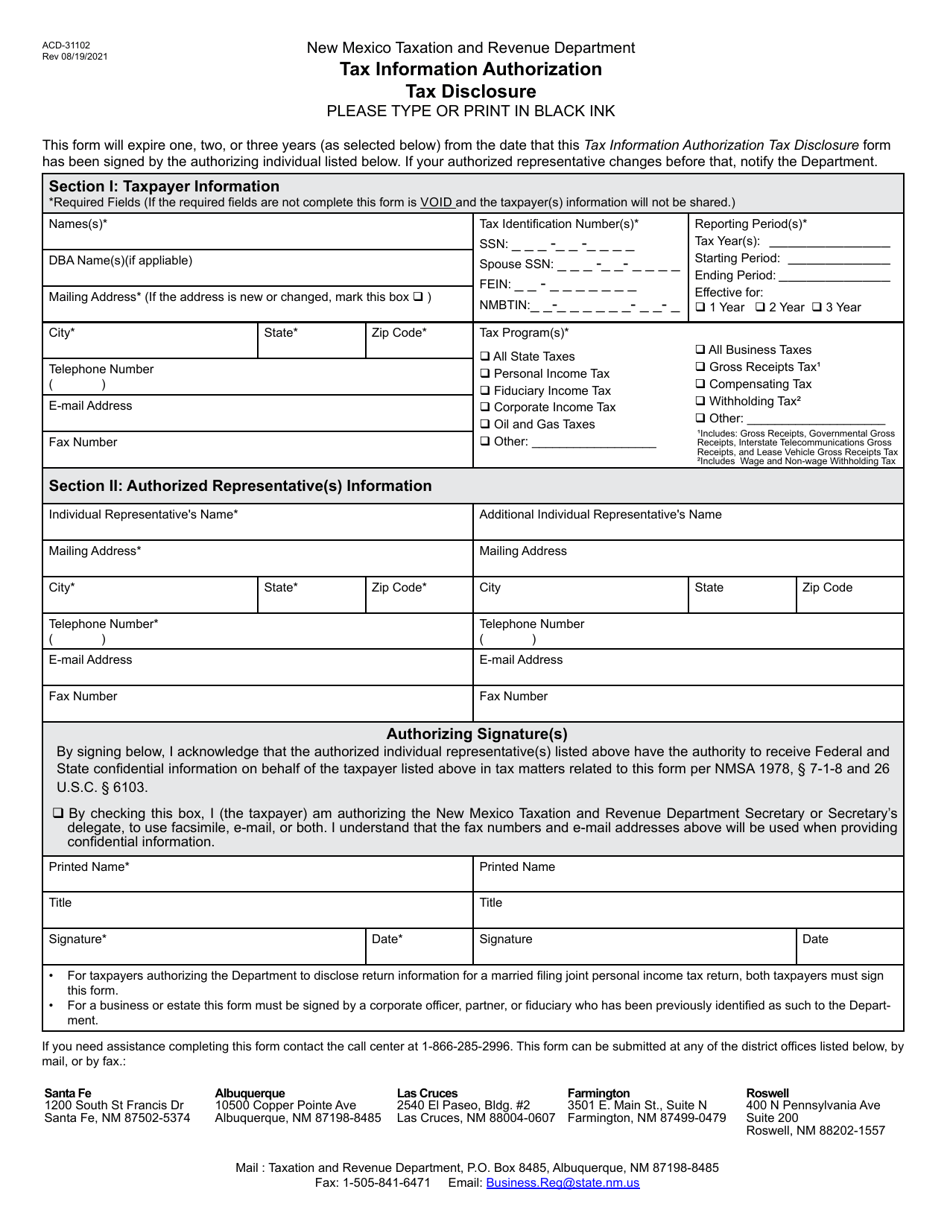

Form Acd 31102 Download Fillable Pdf Or Fill Online Tax Information Authorization Tax Disclosure New Mexico Templateroller

Form Fid 1 Nm Fillable Fiduciary Income Tax Return

Nm Trd Pit 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

How To Get A Non Taxable Transaction Certificate In New Mexico Startingyourbusiness Com