indiana inheritance tax exemptions

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. The amount of each.

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS.

. Each heir or beneficiary of a decedents estate is divided into three classes. The proceeds from life insurance on the life of a decedent are exempt from the inheritance tax imposed as a result of his death unless the proceeds become subject to distribution as. All Major Categories Covered.

For individuals dying after December 31 2012. Indiana statutes CHAPTER 3. Repeal of Inheritance Tax PL.

This means without an Indiana inheritance tax Indiana estates have to be greater than 525 million before any state or federal death taxes would be due. For individuals dying after December 31 2012. The item Inheritance tax.

IC 6-41-3-1 Exempt transfers Sec. How much money can you inherit without paying inheritance tax. Complete Edit or Print Tax Forms Instantly.

205 2013 Indianas inheritance tax was repealed. In 2021 the credit will be 90 and the tax phases out completely. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Each class is entitled to a specific exemption IC6-41-3-91. How much money can you inherit without paying inheritance tax. Ad Access Tax Forms.

No inheritance tax returns Form IH-6 for Indiana. Repeal of Inheritance Tax PL. In addition no Consents to Transfer Form.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. Spouse Children Grandchildren Parents.

Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana. Up to 25 cash back They do not owe inheritance tax unless they inherit more than 500. Allowable exemptions are unlimited for Decedents surviving spouse and for qualified charitable entities.

Anyone who doesnt fit into Class A or B goes hereincluding for example aunts. No inheritance tax returns Form IH-6 for Indiana. 205 2013 Indianas inheritance tax was repealed.

Inheritance Tax Exemptions and Deductions. In 2021 the credit will be 90 and the tax phases out completely. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your.

Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption.

Code 6-41-3-10 through 6-41-3-12 for specific. An Indiana Inheritance Tax Return IH-6 must be filed on behalf of all beneficiaries if the exemptions do NOT exceed the gross estate. No tax has to be paid.

Select Popular Legal Forms Packages of Any Category. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Indiana Estate Tax Everything You Need To Know Smartasset

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Indiana State Taxes Personal Finance Scnow Com

Death And Taxes Nebraska S Inheritance Tax

Form Ih 6 Indiana Inheritance Tax Return Note Local Courts May Require This Form To Be On Green Paper

.png)

Iowa Inheritance Tax Law Explained

Transfer On Death Tax Implications Findlaw

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

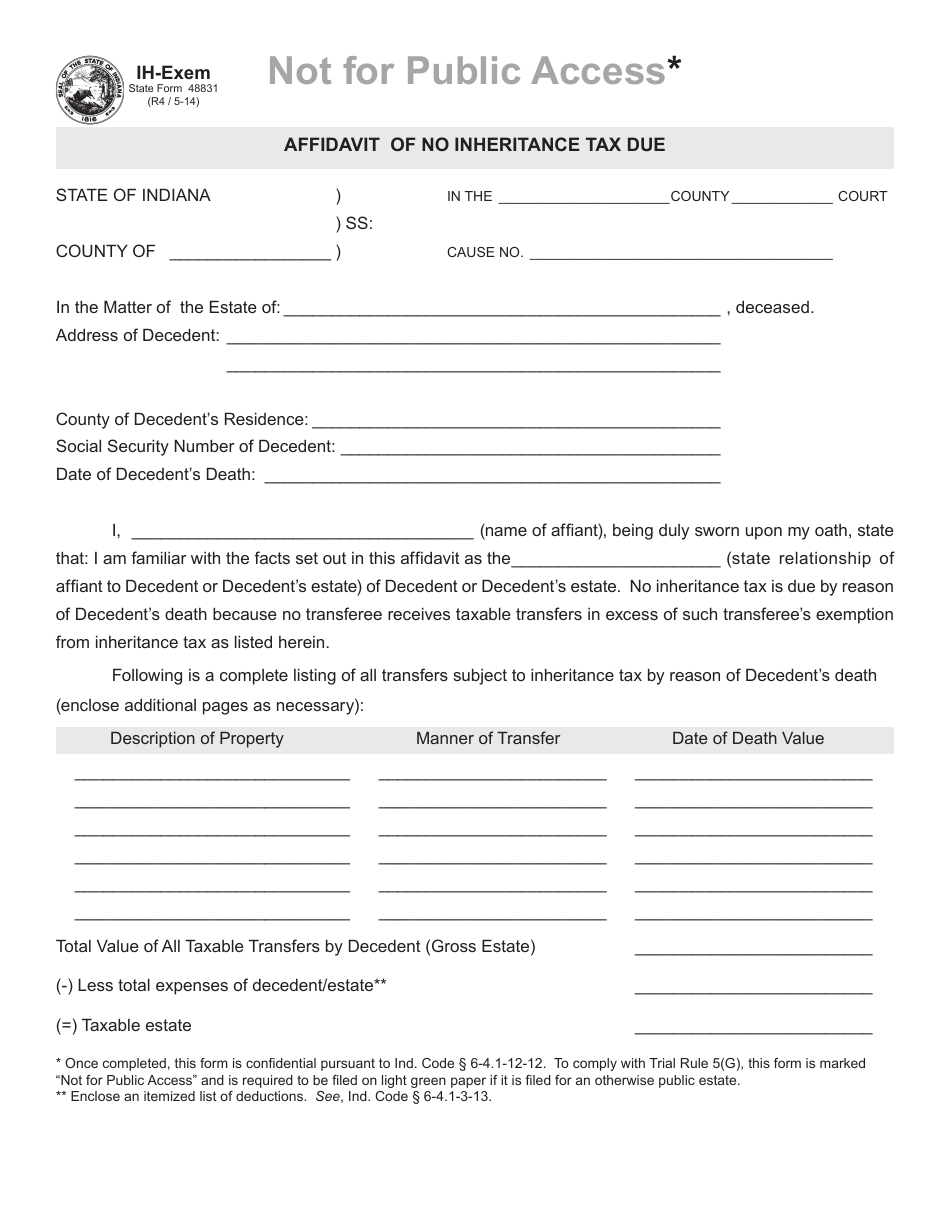

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group